Posted On Nov 26, 2025

Your mortgage renewal letter just arrived in the mail, and you're tempted to sign it and send it back without a second thought. After all, it seems straightforward enough, right? Unfortunately, this approach could cost you thousands of dollars over your next mortgage term.

Most Canadian homeowners make critical mistakes during their mortgage renewal process, often because they don't realize how much control they actually have. The good news? Every single one of these mistakes is completely avoidable when you work with an experienced mortgage broker.

Let's dive into the seven most expensive mistakes you might be making – and how we can help you fix them.

Mistake #1: Starting Your Renewal Process Too Late

You know that renewal notice sitting on your kitchen counter? If it just arrived and your renewal date is in the next 30 days, you're already behind. Most lenders send renewal offers 30-120 days before your renewal date, but waiting until the last minute leaves you with virtually no negotiating power.

When you're rushed, you'll likely accept whatever offer lands in your mailbox first. This time crunch prevents you from shopping around, comparing rates, or negotiating better terms. You're essentially trapped into taking whatever your current lender offers.

How a broker fixes this: We start the renewal conversation 120 days before your renewal date. This gives us plenty of time to review your current situation, explore all available options across multiple lenders, and negotiate on your behalf. You'll never feel pressured to make a quick decision when we're managing your timeline.

Mistake #2: Automatically Accepting Your Lender's First Offer

Here's what most people don't know: your lender's initial renewal offer is rarely their best offer. Banks count on customer inertia – they're betting you'll sign that convenient renewal letter without shopping around or negotiating.

Think of it like buying a car. You wouldn't pay the sticker price without negotiating, would you? Yet that's exactly what happens when you automatically accept your renewal offer. Even a seemingly small difference of 0.25% in your interest rate can save you thousands of dollars over a typical five-year term.

How a broker fixes this: We have access to rates and terms from dozens of lenders, not just your current one. We compare your existing offer against what's available in the market and negotiate better terms on your behalf. Often, we can secure rates that are significantly lower than what appeared in that initial renewal letter.

Mistake #3: Obsessing Over Interest Rates (And Ignoring Everything Else)

Interest rates grab all the headlines, but focusing solely on getting the lowest rate can actually cost you money in the long run. What about prepayment options? Penalty calculations? The ability to increase your payment amount? These features can be worth more than a small rate difference.

For example, one lender might offer a rate that's 0.1% higher but allows you to prepay 20% of your principal annually without penalty. Another might have a lower rate but restrict you to only 10% prepayments and charge higher penalties if you need to break your mortgage early.

How a broker fixes this: We look at your complete mortgage package, not just the interest rate. We evaluate prepayment options, penalty calculations, payment flexibility, and renewal terms to ensure the entire package aligns with your financial goals and lifestyle needs.

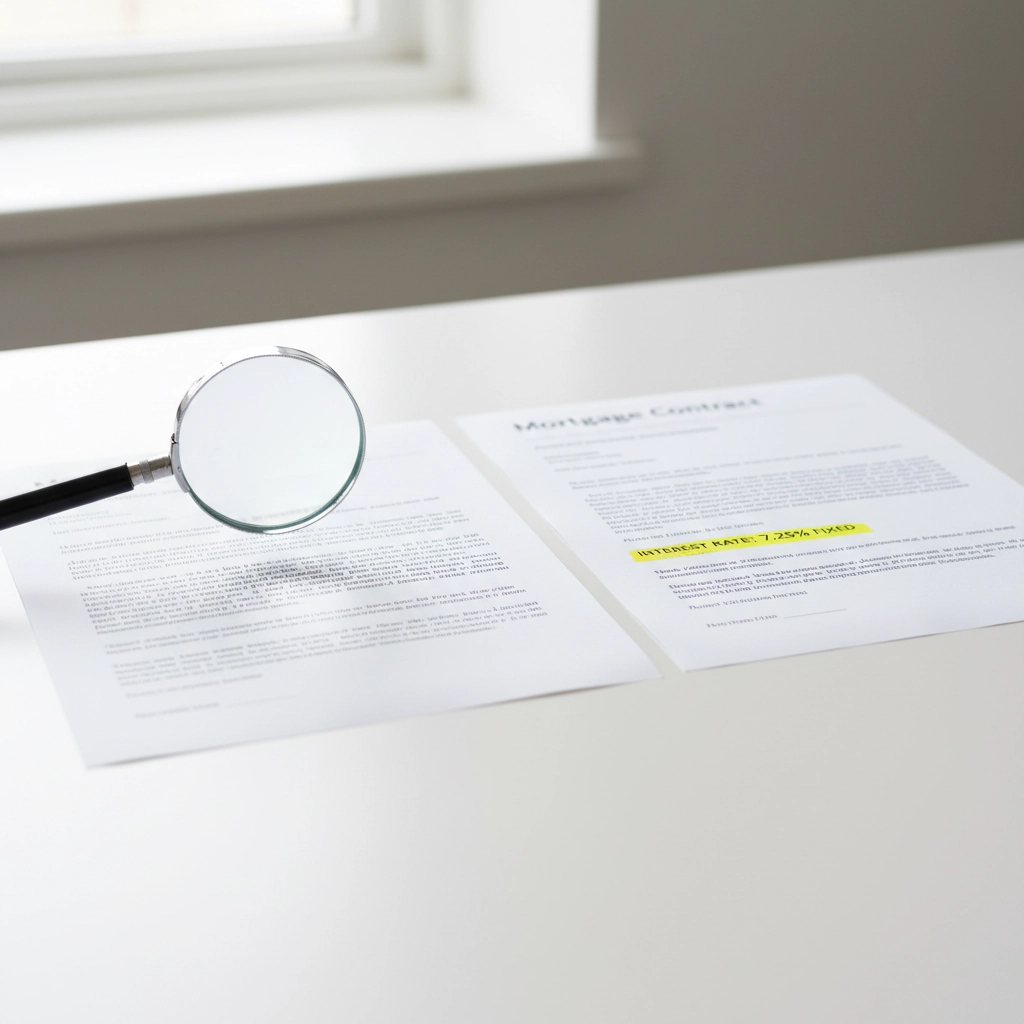

Mistake #4: Skipping the Fine Print

Mortgage contracts are dense, complex documents filled with legal terminology that can significantly impact your finances. Most homeowners skim through or completely skip reading the fine print, missing crucial details about fees, penalties, and restrictions.

These overlooked clauses can come back to haunt you. Maybe you discover later that your mortgage has higher-than-expected discharge fees, or perhaps the prepayment terms aren't as flexible as you thought. By then, you're locked into these terms for your entire mortgage term.

How a broker fixes this: We walk you through every aspect of your mortgage contract in plain English. We highlight potential red flags, explain what each clause means for your specific situation, and ensure you understand exactly what you're signing before you commit.

Mistake #5: Ignoring How Your Life Has Changed

Your mortgage should evolve with your life, but many homeowners stick with the same mortgage structure year after year, regardless of how their circumstances have changed. Maybe you've gotten married, had children, received a promotion, or are approaching retirement – all of these life changes should influence your mortgage strategy.

If you're now earning significantly more than when you first got your mortgage, you might benefit from accelerated payment options. If you're nearing retirement, you might want to focus on paying down your mortgage faster. If you've had kids, you might need more payment flexibility.

How a broker fixes this: We take time to understand where you are in life right now, not just where you were when you first got your mortgage. Based on your current financial situation and future goals, we recommend mortgage structures and terms that make sense for your life today.

Mistake #6: Assuming You Have No Negotiating Power

Many homeowners believe they have no choice but to accept whatever terms their current lender offers. This couldn't be further from the truth. Lenders want to keep you as a customer, and they're often willing to negotiate better terms to prevent you from switching to a competitor.

You might be surprised to learn that you can negotiate not just interest rates, but also prepayment options, payment frequency, and even some fees. However, most people don't even try to negotiate because they don't know it's possible or don't feel confident in their negotiating skills.

How a broker fixes this: Negotiation is what we do every single day. We understand what different lenders are willing to offer and how to position your application to get the best possible terms. We leverage our relationships and market knowledge to secure deals that typically aren't available to individual consumers.

Mistake #7: Overlooking Your Credit Score Impact

Your credit score plays a huge role in determining your mortgage rates and terms, yet many homeowners never check their credit before renewal. If your credit score has improved since you first got your mortgage, you might qualify for better rates. If it's declined, you'll want to know about potential issues before they impact your renewal.

Credit problems don't fix themselves, and waiting until renewal time to discover issues leaves you with limited options. On the flip side, if your credit has improved significantly, you might be leaving money on the table by not leveraging that improvement.

How a broker fixes this: We review your credit situation well before your renewal date and can guide you on improving your score if needed. We also understand which lenders are more flexible with credit issues and which ones reward excellent credit most generously. This knowledge helps us position you with the right lender for your specific credit profile.

The Real Cost of These Mistakes

Let's put this into perspective with real numbers. On a $400,000 mortgage, a difference of just 0.5% in your interest rate over a five-year term will cost you approximately $10,000. Add in less favorable terms, higher penalties, and missed opportunities for accelerated payments, and these mistakes can easily cost you $15,000-$25,000 or more.

Now multiply that across multiple renewal cycles over the life of your mortgage, and you're looking at tens of thousands of dollars in unnecessary costs.

Your Renewal Strategy Starts Here

The mortgage renewal process doesn't have to be stressful or expensive. When you work with our team at Tina Dahl - The Mortgage Centre, we handle every aspect of your renewal, from initial market research to final contract negotiation.

We start early, compare all your options, negotiate aggressively on your behalf, and ensure you understand every detail of your new mortgage terms. Most importantly, we focus on your complete financial picture – not just getting you the lowest rate, but securing the mortgage package that best supports your financial goals.

Ready to avoid these costly renewal mistakes? Contact us today to discuss your upcoming renewal, or learn more about the broker advantage and how we can help you save money on your next mortgage term.

Your renewal letter might make it seem like you have no choice, but you have more options than you realize. Let us show you what's possible when you have an experienced mortgage professional in your corner.